Aggressive interventions by Chinese authorities were a notable theme on the week (strong-arming funds not to sell stocks, tapping banks on the shoulder to buy yuan against the dollar, and making firms an offer they can’t refuse with regard share buybacks). However, Chinese stocks closed lower…

Source: Bloomberg

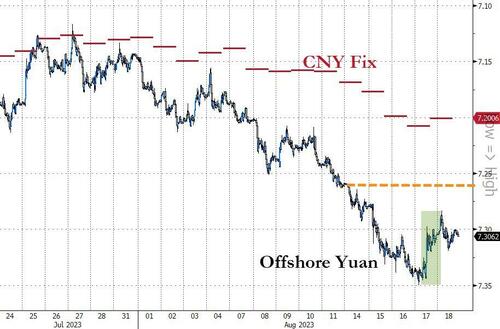

..and so did the offshore yuan…

Source: Bloomberg

So Mission Unaccomplished Beijing.

Interestingly, Goldman traders suggest that:

“to this point in the sequence, I’d argue the slowdown in China had been a net positive for US equities… with specific regard to the disinflationary impulse and the flow of capital...

…that said, coming out of a week that featured another disappointing set of data… and another dose of CNH weakness…

…it now feels like China growth fears can provoke a more global risk-off dynamic“

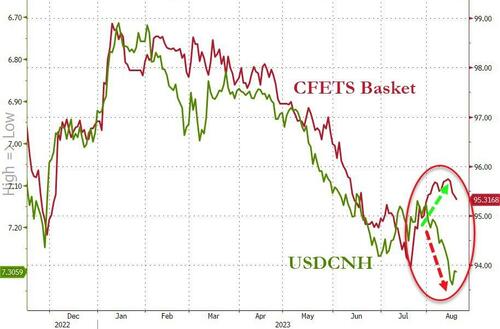

But, bear in mind that while the yuan has been spanked like a monkey against the dollar, it has actually rallied against the rest of its trading partners’ currencies…

Source: Bloomberg

And while Chinese data was a shitshow, US macro (hard and soft) surprised to the upside this week…

Source: Bloomberg

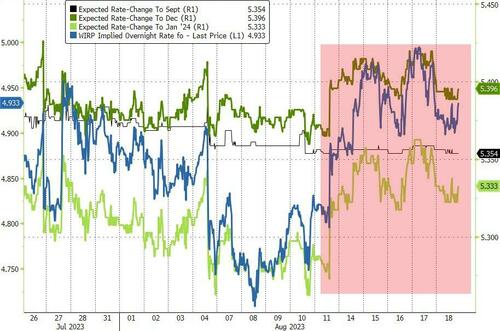

Which, combined with relatively hawkish Fed Minutes pushed rate expectations higher on the week (reducing expectation for cuts next year also)…

Source: Bloomberg

This prompted ‘risk-off’ as the S&P fell for the 3rd straight week, its longest weekly losing streak since Feb, and suffered its biggest weekly loss since the collapse of SVB in March. Small Caps were the ugliest horse in the glue factory…

All of the US Majors closed below their 50DMAs (note in upper right that Small Caps dropped to 100DMA and bounced)…

The S&P 500 closed down 0.01% today (lol!!!) as the algos ran the stop but couldn’t keep it green…

Regional bank stocks fell for the 3rd straight week…

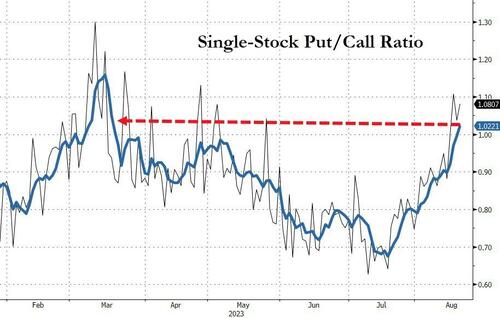

The put/call ratio surged up to the highest since the SVB collapse…

Source: Bloomberg

Read more here…